There’s a pretty good chance that most American car shoppers know about the federal electric-vehicle tax-credit incentives. In short, buyers of certain new electric vehicles may qualify for up to $7500 in purchase assistance from the federal government in the form of a tax credit.

More electric-vehicle news and reviews

How The Federal Used-EV Tax Credit Works

The tax credit is not a given for all new EVs, however, as there are a number of restriction on the incentive, including things like household income, vehicle nation-of-assembly, and domestic-material content of the battery. It is because of these requirements that very few vehicles actually qualify for the money—here’s a list of those that do. However, many of these constraints can be sidestepped by leasing the vehicle in question—a loophole in the original legislation designed to accommodate business/commercial EV shoppers, but is available to all EV buyers.

What many EV purchase intenders may not know, is that there is a similar incentive available to buyers of used electric vehicles, and it’s far less complicated to take advantage of than the new-EV program.

Beginning back on January 1 of 2023 as part of the Inflation Reduction Act, the program can offset a considerable amount of the purchase price of a used electric vehicle. but there are restrictions, and one very cool inclusion not afforded new-EV shoppers. Here are the rules:

Used EV must cost less than $25,000

To clarify, the $25,000 price must be inclusive of all options and equipment, even things like an extended warranty. The only costs not included in the price cap are taxes, title, and registration fees.

Used EV must not have been sold as used before

Interestingly, the used EV in question must have been new the last time it was sold. The third purchasers of the vehicle will not quality for any federal incentive.

Used EV must be purchased at a dealership

Unfortunately, private-party sales will not quality for the incentive. Also, there is some paperwork to do (see below).

Used EV purchasers cannot be making too much money

To qualify for the used-EV incentive, shoppers must come in under prescribed income caps as follow:

- Married couple, filing jointly: Less than $250,000

- Head of household: Less than $112,500

- Individual: Less than $75,000

Note, too, the incentive applies only to private individuals, and is not available to commercial entities. In addition, fuel-cell vehicles, and plug-in hybrid vehicles with a battery capacity of at least 7 kWh also quality for used-EV incentives.

Good News

And, here’s some good news: As long as the used electric vehicle in question has a gross vehicle weight rating (GVWR) of less than 14,000 pounds, it qualifies for the incentive—it does not need to have appeared on the federal incentive list as a new car.

As for the GVWR, no need to worry. Even the Tesla Cybertruck and the massive GMC Hummer fall under that limit.

The Math

So, how does the incentive work? The credit amount is for 30 percent of the sale price of the vehicle, up to $4000. So, if you purchase a $12,000 used electric vehicle, Uncle Sam will compensate you to the tune of $3600. If you purchase a $24,000, you only get $4000—the cap—though 30 percent of that price comes to $7200.

The Paper Work

You can apply the incentive at the time of purchase, but even if you do so, you need to fill out IRS form #8936—and be sure that you do. Your accountant will need to confirm that you did indeed qualify for the incentive.

Tip: Call your accountant before taking advantage of the used-EV incentive—just in case. If you do not qualify, the government is going to want its incentive money back, which is probably a pretty ugly situation. Note that the dealer cannot determine whether or not your income falls under the guidelines outlined by the government, so you need to make sure on your own.

Used EV Prices (Act Now?)

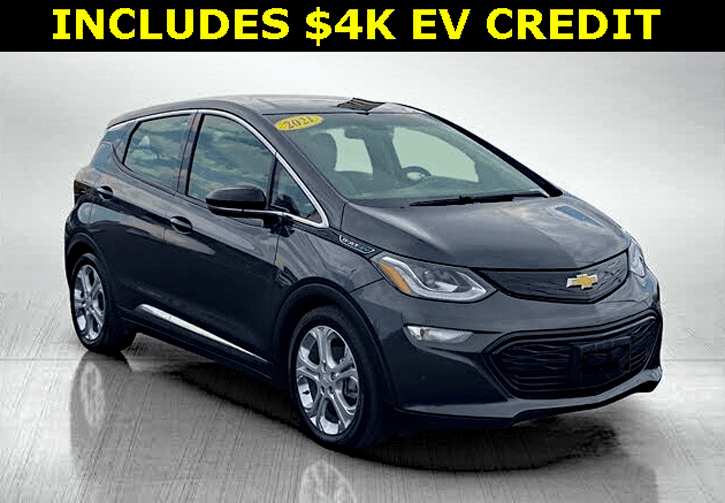

At the time this was published, dealer lots were packed with surprisingly affordable used electric cars, most comfortably under $25,000. This might be a great time to test the waters of EV ownership without committing to a pricey new plug-in vehicle.

Listen to the Car Stuff Podcast

Used Electric Vehicle Pictures

Click below for enlarged images