Telsa has been grounded. Once a Wall Street juggernaut with an improbable capitalized value of $1.2 trillion, the electric-vehicle maker is now worth just $535 billion. That’s still a considerable sum—more than the cap value of Toyota and General Motors combined—but it does represent a hard fall for a company that seemed incapable of taking a wrong turn. -Why Tesla Sales Are Tanking

Why Tesla Sales Are Tanking

After years of seemingly blind financial fealty, investors have finally come to question Tesla’s future, taking note of recent–hugely damaging–price cuts, as well as company investment in questionable projects including the controversial and defect-plagued Cybertruck, and limited-value autonomous-driving systems.

New Tesla registrations are down significantly in March and April, this despite the overall EV market actually growing. While makers including BWM, Ford, and Hyundai have enjoyed EV sales growth in 2024, Tesla sales are in a tailspin.

Part of Tesla’s problem is competition. Other carmakers are steadily rolling out new and compelling EV products, while Tesla has done little to update its own lineup. The result is a decline in U.S. EV market share from roughly 80 percent in 2020, to 67 percent at the beginning of 2023, to 52 percent this past April. And while controlling half the market seems like a strong position, Tesla has spent heavily on incentives and price cuts to maintain that share, taking a serious toll on profits.

Telsa’s problems go beyond just aging product, however, as many of the processes inherent in being a direct-to-consumer retailer may now be playing against the company. Here we’ll look at five reasons why Tesla sales are in a freefall, and why these problems will be difficult to correct.

Tesla Product is Old

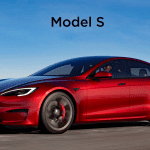

As noted above, Tesla has done remarkably little to keep its product lineup fresh. The Model S large sedan, introduced way back in 2012, has been tweaked over the years, but still looks basically the same is it did when introduced. The model X midsize crossover dates back to 2015, and has similarly been neglected since its rollout.

The popular Model 3 small sedan is newer, dating back to 2017, and—you guessed it—never been significantly freshened. Tesla’s hottest seller, the Model Y small crossover, dates back to just 2019, and has seen some design tweaks, but nothing of consequence.

And while the Cybertruck is brand new, it’s being produced in tiny numbers, as quality-control issues and defects have limited production ramp-up.

The problem here is not only that newer products from market-place competitors look and feel more modern, but that there is no compelling reason for existing Tesla owners, of which there are roughly 5 million globally, to trade in their cars—at least for another Tesla.

Price Cuts are Damaging

Thinking short-term, Telsa has responded to its recent sales situation with massive price cuts, affecting all four of its core models. The base price for a Dual Motor AWD Model Y was as high as $66,000 in 2019. This author knows of a similar 2024 model—including several Tesla discounts—that sold for just $42,000.

While Tesla is keen to maintain its dominant market share, the maker has another reason to keep its sales volume as high as possible. Sam Fiorani, Vice President of Forecasting at industry consultancy AutoForecast Solutions, reports that Tesla’s main price-cut objective is to keep factory utilization as high as possible.

It’s largely understood that for an auto factory to be profitable, it must operate at roughly 80-percenty capacity. Tesla has four factories worldwide, including two in the U.S. It’s largest production facility, in Shanghai, China, is capable of producing nearly 1 million vehicles annually. And, as in the U.S., Tesla is experiencing a serious sales downturn in China. And as in the U.S., Tesla is cutting prices in that country as well.

The downside of new-car price cuts is, unfortunately, reduced resale values. Since Tesla began discounting its vehicles late in 2023, the resale values of its cars and crossovers have plunged. The net result is a not only a potential brand buyer base with less money to put down on a new vehicle, but also a population of very angry brand owners. Per Forbes, the value of a used Model Y has fallen 32 percent in the last 12 months, and 12 percent this year alone.

Tesla Store Are Hard to Find

Tesla breached automotive marketing protocol some 20 years back when it opted to sell cars to consumers directly from the factory. The company is still embroiled in a number of lawsuits as result of this arrangement, as factory-to-consumer sales violate franchise laws in most U.S. states.

More importantly, however, is that as Tesla sales grew, the company seemingly ran out of new-car shoppers willing to purchase a car sight-unseen from a store many miles away. Indeed, reports suggest that many Tesla owners did not test drive their vehicles prior to purchase.

Tesla now needs mainstream–non-early-adopter—customers to maintain its sales growth, and it seems at least some of those shoppers want the security of having a dealership nearby, this for test drives, service, and warranty repairs. The problem is Tesla doesn’t have very many brick-and-mortar locations.

Nationally, Tesla has just 245 facilities, not all of which handle repairs. Toyota, on the other hand has almost 1300 operating dealerships in the U.S. Even struggling Mitsubishi has more than 300 dealership in the U.S. Additionally, there are half a dozen U.S. states with no Tesla store at all.

A first-time EV shopper with some reservations about after-sale service isn’t very likely to pull the trigger on a car that can’t be worked on within five miles of his or her home. For many shoppers, this rules Tesla out.

Full Self Driving (FSD) Is No Longer Hands Free

One of any Tesla’s most-noteworthy selling features is the Full Self Driving (FSD) semi-autonomous driving system. The FSD System, and its predecessor Auto Pilot, have been famously misused by Tesla drivers, many of whom have been recorded sleeping behind the wheel of a moving vehicle. There are plenty of such videos on YouTube. Further, Tesla seemed, at least initially, to condone these activities, acting slowly to curb the system’s abuse.

Tesla recently made the feature available to owners for no-cost 30-day evaluations, this in hopes of signing users up for a subscription to FSD after the free-trial period. This writer evaluated the system himself, with the assistance of Green Sense Show host Robert Colangelo, who recently took delivery of his own Model Y.

Though the system worked almost perfectly—it can be slow around corners—we learned to our shock and dismay that FSD is no longer hands free. Likely recoiling from regulatory pressure to reel-in dangerous abuse of the system, Tesla now requires users to keep their hands on the steering wheel at all times.

After years of development, Tesla’s autonomous-driving system is now less useful than similar products offered on Ford and General Motors vehicles. And, Tesla wants users to pony up $99 a month for the privilege of holding the wheel as the car rounds corners or changes lanes on its own.

Not only is FSD no longer a selling point, it seems like a waste of money. Tesla owners seem to agree, as only a small number have reportedly subscribed to use the product long term.

Elon Musk Is Not Helping Matters

Once viewed as a visionary, Tesla CEO and guiding star Elon Musk has become something of an industry pariah, and some would-be customers are thinking twice about supporting him or his company. Unlike many corporate leaders, Musk has famously made his personal politics public. This is especially odd as EV buyers tend to trend as politically liberal, and likely do not identify easily with Musk’s public position on most issues. One recent study suggested that 20 percent of EV intenders will not consider a Tesla product because they disapprove of Elon Musk’s attitudes and behavior.

It gets a little weirder for investors. Elon Musk has demonstrated profound stubbornness when it comes to certain projects, many of which seem unlikely to yield near- or mid-term profit. Consider the Model X, which was rolled out in 2015. For no practical reason, Musk insisted on equipping the crossover with what are called “Falcon Wing” doors. The pop-up doors—which do make it easier to enter the vehicle—were complicated to produce, and ultimately problematic in the field. Still, Musk insisted on their use, which delayed the X’s introduction, and required a number of updates once in owners’ hands.

Now Musk is dead-set on producing an autonomous ride-hailing vehicle—this instead of an affordable small EV—for reasons that are not clear to industry observers. Consider that in the past year Tesla’s autonomous-driving system has become less useful, one wonders about the capital and man power that will be pulled away from updating core products for what is likely to be a boondoggle. As many analysts now believe that truly autonomous vehicles are still at least a decade away from regular production, Musk’s unmanned ride-hailing car is not likely to contribute to the bottom line for quite some time.

As a bonus, Musk recently fired the company’s entire Super Charger charging-network staff, a move which likely alarmed Tesla owners, would-be owners, and stockholders alike.

For many EV customers, all of this drama should make a Hyundai Ioniq 5, Chevrolet Blazer EV, or any non-Tesla EV that much more attractive.

Tesla Sales are Tanking Gallery

(Click below for enlarged images)

Why Tesla Sales Are Tanking

Consumer Guide Car Stuff Podcast Episode 218: Test Driving Tesla’s FSD (Bonus Episode)

And, some people would prefer a steering wheel to a yoke.