It may be a matter of semantics, but when I hear the word “deal,” I assume that the terms of a contract or business transaction were arrived at by means of mutual agreement. If you, the consumer, strike a deal to purchase a vehicle, that means that you and the seller have agreed to the price of that car or truck. That said, I have serious problem with what used-car retailer DriveTime is currently referring to as a deal in its commercials.

It may be a matter of semantics, but when I hear the word “deal,” I assume that the terms of a contract or business transaction were arrived at by means of mutual agreement. If you, the consumer, strike a deal to purchase a vehicle, that means that you and the seller have agreed to the price of that car or truck. That said, I have serious problem with what used-car retailer DriveTime is currently referring to as a deal in its commercials.

More car-shopping news and advice

DriveTime’s Deceptive Ads

DriveTime, which until 2002 was named Ugly Duckling, is a national chain of used-vehicle stores with a significant online presence. DriveTime sells only used cars, and employs a “one-price,” haggle-free pricing strategy. For many customers, not having to negotiate a price takes much of the stress out of the vehicle-purchase process.

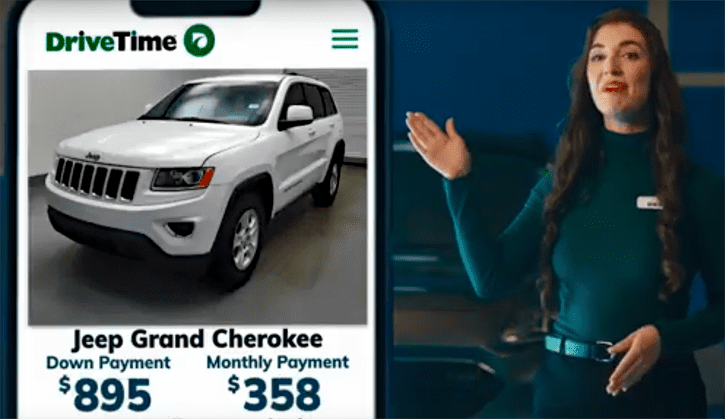

Because the chain also provides financing, customers can handle almost all of the paperwork in advance of taking vehicle deliver at one of DriveTime’s 165 locations. DriveTime’s website is reasonably easy to use, and the company—via its TV ads—strongly encourages use of the retailer’s app. Though DriveTime caters to customers with marginal credit, it will gladly sell a vehicle to anyone, bad credit or not.

Because the chain also provides financing, customers can handle almost all of the paperwork in advance of taking vehicle deliver at one of DriveTime’s 165 locations. DriveTime’s website is reasonably easy to use, and the company—via its TV ads—strongly encourages use of the retailer’s app. Though DriveTime caters to customers with marginal credit, it will gladly sell a vehicle to anyone, bad credit or not.

Hyundai and Amazon: What’s the Deal?

So, what’s my beef? Since DriveTime is a one-price seller, and does not negotiate the prices of its vehicles, there is little for a customer to do but agree, or not, to purchase a car or truck at the advertised price. There really is no deal.

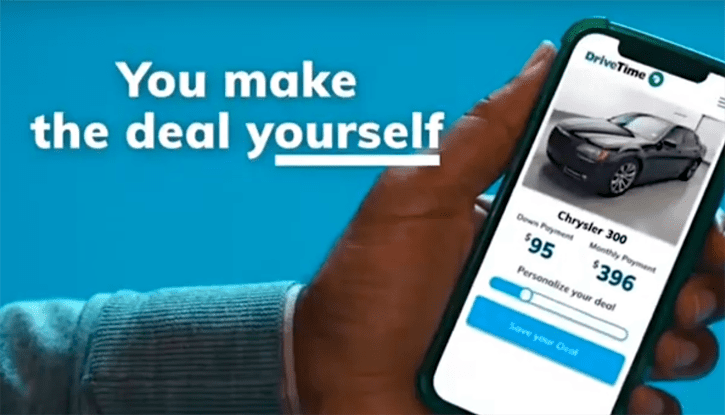

But, despite company’s fixed-price policy, DriveTime’s current crop of commercials promise consumers, “You make the deal!” Adding, “The deal you make on your phone is the deal you pay.” Without hearing anymore, it sounds very much like consumers can, indeed, shave a little off the DriveTime asking price. Alas, that is not the case.

Meet the 2024 Consumer Guide Best Buys

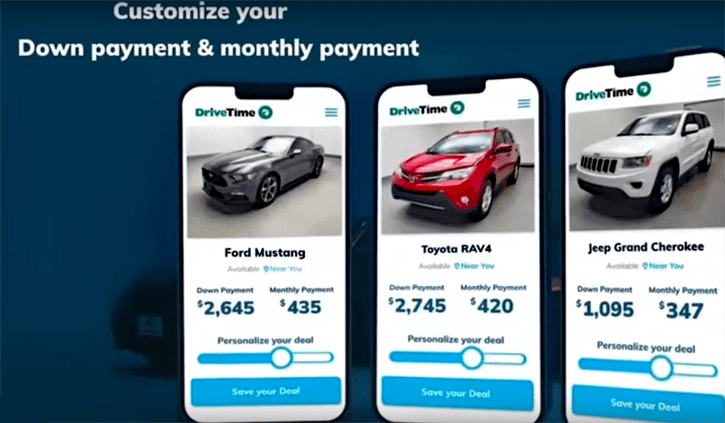

All the hype, and the focus of the commercials shared here, surrounds the DriveTime Real Deal Maker, a tool on the app which allows shoppers to tweak their down payment and monthly payment. That’s it. Raise the down payment, and predictably, the monthly payment drops. Lower the down payment, and the monthly tab rises accordingly. What is not being adjusted—what is not being negotiated in any way—is the actually price of the car, or the interest rate.

All the hype, and the focus of the commercials shared here, surrounds the DriveTime Real Deal Maker, a tool on the app which allows shoppers to tweak their down payment and monthly payment. That’s it. Raise the down payment, and predictably, the monthly payment drops. Lower the down payment, and the monthly tab rises accordingly. What is not being adjusted—what is not being negotiated in any way—is the actually price of the car, or the interest rate.

Confusingly, and misleadingly, the Real Deal isn’t actually a deal at all, it’s just a shell game.

Additionally, lenders generally want at least ten percent down on a used-car purchase, and would prefer 20 percent. It seems unlikely that DriveTime customers, whom are usually burdened by credit issues, are going to be allowed to lower their down payment much, or are able to add much to it, making the “tool” little more than a bit of nonsensical eye candy.

In simplest terms, DriveTime is looking to instill in credit-troubled customers a sense of empowerment, though shoppers have little actual control over the buying process. The terms of the deal, the price and the interest rate, are determined by DriveTime, and there’s nothing the customer can do about it, save for shop elsewhere. Which is why we find this quote from one of DriveTime’s current commercials so troubling:

Then just go to the dealership for a haggle-free purchase, because you already made the deal yourself.

While the Real Deal Maker app tool isn’t employed in anyway to defraud shoppers, it does create the illusion that users have somehow affected the “deal,” and that simply isn’t the case. In fairness to consumers, I suggest that DriveTime change the name of the Real Deal Maker tool to the Real Deal Placebo.

Car Shopping Tips: Test Drive Checklist

Listen to the Consumer Guide Car Stuff Podcast

And, shop around. DriveTime prices seem high.