Fact: Vehicles today are outfitted with more “stuff” than ever before. Standard safety equipment, sophisticated infotainment/connectivity systems, and a general desire for luxury features have combined to drive the average transaction price on new vehicles sold in the U.S. to almost $34,000. More sobering: The average transaction price on a new pickup comes in around $43,000.

Should I Buy A Used Car From Enterprise?

To help keep their vehicles affordable, consumers have been taking on loans with longer payback periods. Not so long ago, a 48-month loan was considered the industry standard. Today, the average loan length is 68 months–and 84-month loans are no longer uncommon. And what of the average new-car payment? Per USA Today, consumers are now paying $503 a month, on average, for their new cars and trucks.

Still, for every $53,000 Jeep Grand Cherokee being financed, there are plenty of more-affordable new and used cars and crossovers available for shoppers who are looking to live a little more frugally.

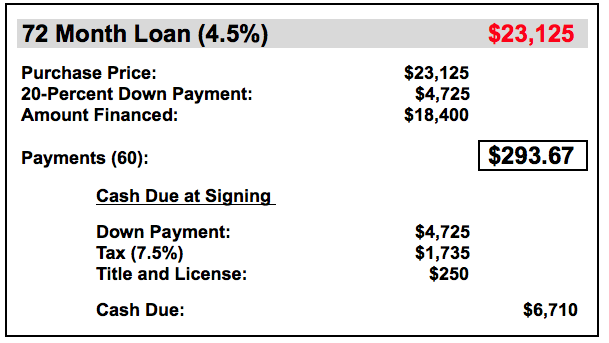

Here, we look at crossovers you can buy for $300 a month, assuming loan lengths of 48, 60, or 72 months. As a general rule, Consumer Guide doesn’t recommend loans as long as 72 months, but we might make an exception when the payments are low, and/or the vehicle being purchased has a record of strong resale value.

Some notes about the payment schedules seen here:

- We assume that a 20-percent down payment is being made. A lower down payment will likely affect the interest rate, and raise the monthly payment amount.

- We assume that taxes, title costs, and license feels are being paid in cash. These costs can be rolled into the loan, but will raise the monthly payment.

- We are assuming a 4.5-percent interest rate, which is common as of this writing. Rates may rise at any time. Consumers with lower credit ratings can expect to pay a higher interest rate, which will raise the monthly payment.

- We assume the down payment is in the form of cash. A vehicle trade-in would lower the sales tax paid on the new car, as only the difference in the price of the new vehicle and the value of the traded-in vehicle is taxable.

- We are assuming a 7.5-percent tax rate. State and local taxes will vary, and may be considerably lower or higher than 7.5 percent.

Note also that our examples include a new vehicle from a new-car store, a used car from a new-car store, and a used vehicle from a rental-car dealer. A private-party purchase, for consumers comfortable with such transactions, would likely yield a lower purchase price, though independent financing arrangements would need to be made.

Should I Buy a New or Used Car?

Impact of Loan Length on Purchase Price

Best Crossovers for $300 a Month

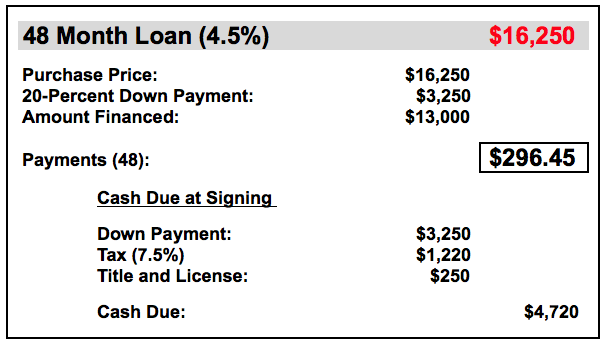

48 Months

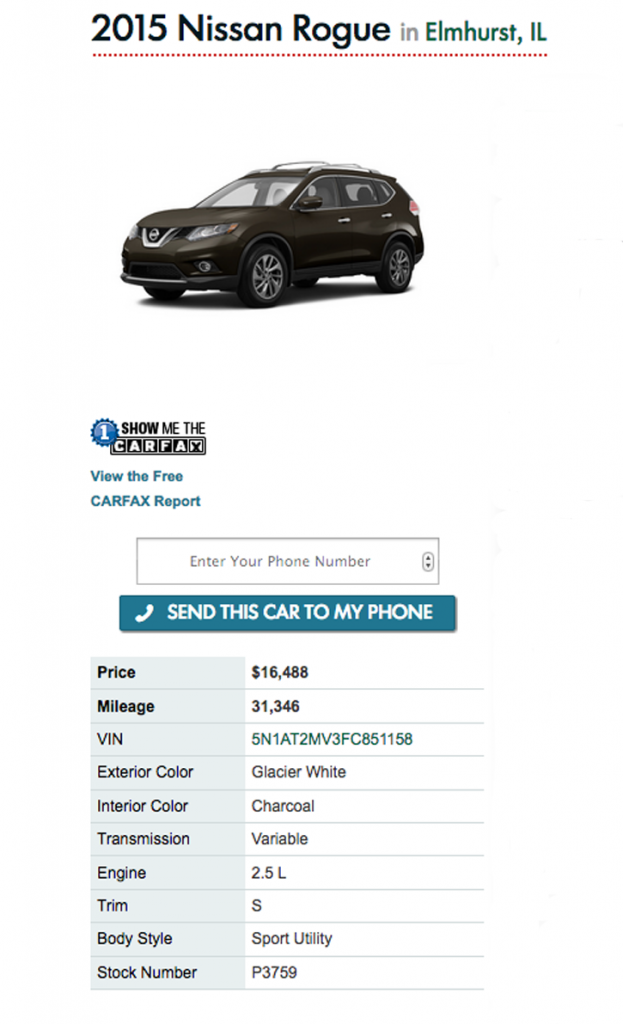

This front-wheel-drive 2015 Nissan Rogue was listed on DriveChicago, an aggregate listing site for new-car dealers in the Chicago area. Assuming the asking price on this Rogue is firm, monthly payments would come to around $301–right at our budget. An AWD example would add about $20 to the monthly payments.

This front-wheel-drive 2015 Nissan Rogue was listed on DriveChicago, an aggregate listing site for new-car dealers in the Chicago area. Assuming the asking price on this Rogue is firm, monthly payments would come to around $301–right at our budget. An AWD example would add about $20 to the monthly payments.

Check out our Compact Crossover Best Buys

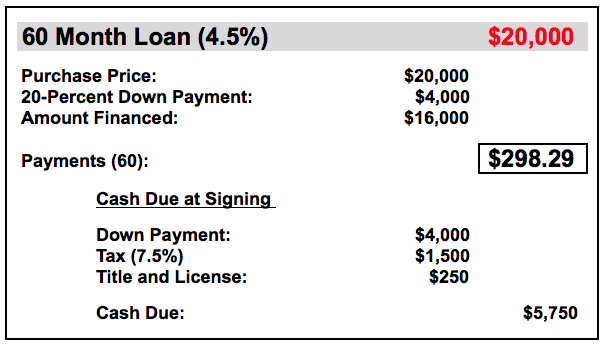

60 Months

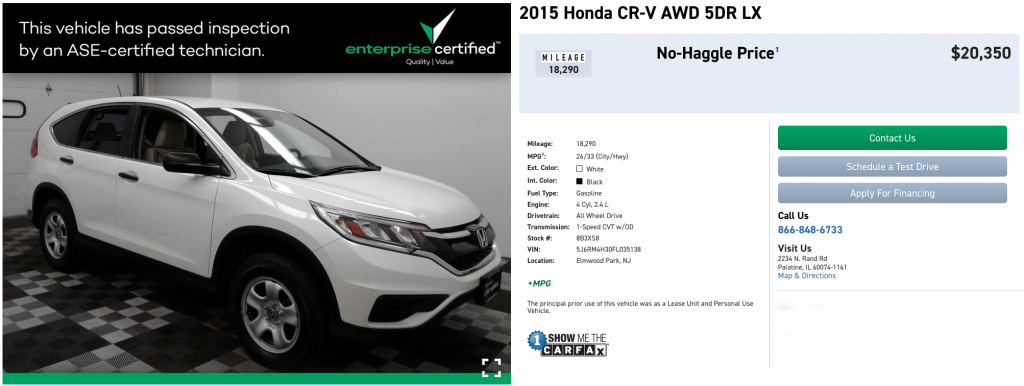

This front-wheel-drive 2015 Honda CR-V was listed on the Enterprise Car Sales site. At this price and as equipped, this small Honda Crossover would come to $304 monthly, only slightly over our $300 budget. An AWD example would run roughly $15 more each month.

7 Fastest Small Crossovers of 2018

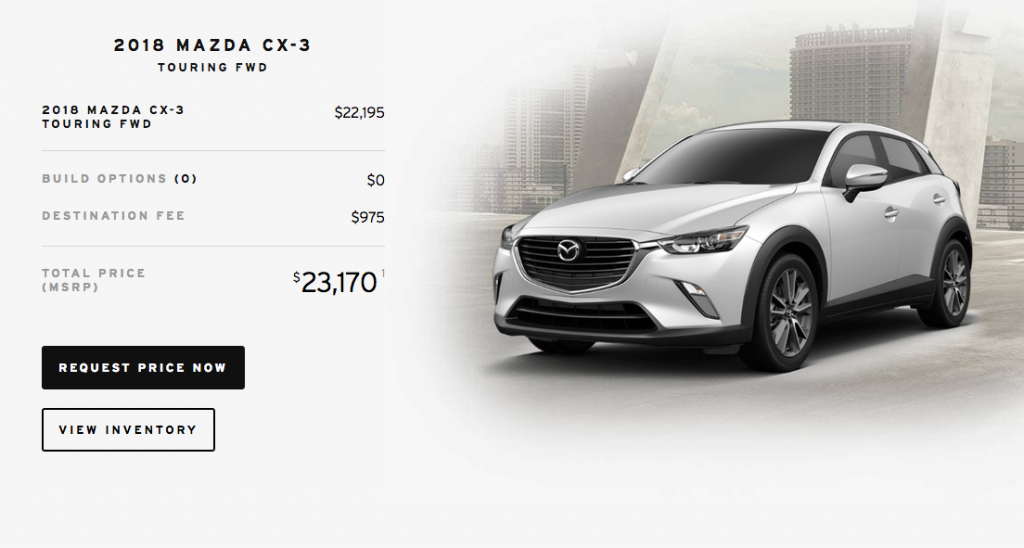

72 Months

This new front-wheel-drive, midlevel CX-3 lists for a reasonable $23,170, though Ceramic Metallic (shown) is the only no-cost color option. As shown above, our CX-3 comes to $294 per month, a little under our budget. Going with an AWD example will add $16 to the monthly payment, while an extra-cost color would add $4.