In the past four years, gasoline prices have drifted between $4.00 per gallon on the high side, and roughly $3.25 on the low end. Historically, Americans are paying relatively low prices for fuel at the moment. That said, gas isn’t cheap, exactly, and it consumes are reasonably large chunk of the average consumer’s budget.

Should I Pay Cash for Gas?

Gas as an annual expense

Per investment website Motley Fool, the typical American household purchases roughly 810 gallons of gas annually. At $3.25, that’s more than $2600 a year to fuel the family vehicles. (Also, per Motley, the average vehicle burns between 448 and 522 gallons of gas each year, that’s $1600 to $1700 per each car.)

With gasoline bills closing in on the price of a monthly house payment, it makes sense that American consumers would look for a way to save some money at the gas pump. But apart from hunting for the cheapest gas price at fill-up time, how can a car owner save a little money of gas?

By paying for your fuel with cash.

History of cash discounts

Cash discounts for gas are not new, but they are making a comeback. This author was a “pump jockey” (full-service pump attendant) when gas prices surged in 1981. The price of regular gasoline rose from a national average of $.86 in 1979, to $1.77 in 1981. Historically, this was about the most Americans ever paid for gas. In 2025 dollars, that $1.77 amounts to roughly $6.30 per gallon.

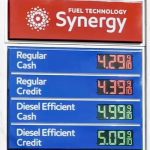

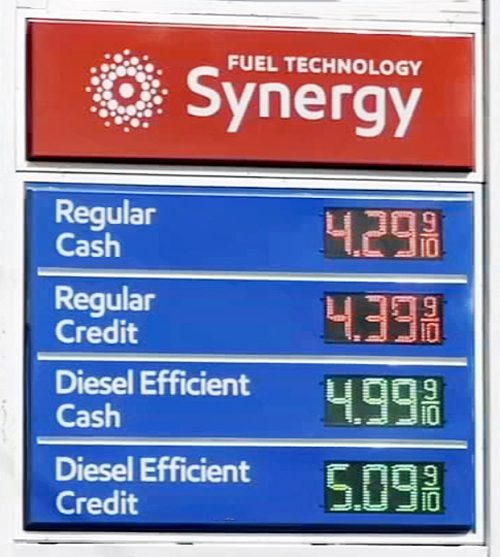

It was at this time that gasoline retailer began offering cash discounts. At the Mobil station I worked at, the discount for paying with cash instead of a credit card was $.03 per gallon. So, customers paying $2.00 per gallon at the full-service pump received $.30 per $20 gas purchase for taking the trouble to pay folding money instead of a credit card.

Luckily for me, most customers just told me to keep the change. Those were good times.

Why do retailers offer cash discounts?

The reason for the discount is simple enough. Credit-card processors charge retailers for the service of handling transactions. The price per purchase can be high. Most credit-card companies charges between 1.5 and 3.5 percent of the purchase amount, with the average coming in at a reported 2.5 percent. These numbers are significant, because most gasoline retailers operate on net margins as low as 2.0 percent.

What about debit cards?

Note that debit cards purchases are also subject to processing fees, though they can be lower than those for traditional credit cards. Retailers typically do not offer discounts for debit-card usage.

Cash payments reduce retailer costs

To circumvent processing fees, many gasoline retailers are again offering discounts for paying for your fill-up with cash instead of a credit card. Though that discount is typically $.05 per gallon, some stores may offer—though often temporarily as a promotion—discounts as deep as $.10 or even $.15.

So, instead of eating the processing fee, some fuel retailers offer the option of paying for your fuel purchase with old-school cash.

Pros and Cons

The question is, is it worth the effort to pay for gasoline with cash, in exchange for a relatively small discount? In examining the cash-versus-credit-card pros and cons, we will assume that the per-gallon discount is $.05, which is typically the case.

Pros

- Saving Money

At $.05 per gallon, the average consumer will save about $.50 to $.75 each fill-up—this assuming an average 10-15 gallon purchase.

- Not Adding to Credit-Car Balance

For folks carrying a credit-card balance, paying cash for at least some purchases can ease the sting of monthly interest payments.

Cons

- Carrying Cash

I don’t use cash much anymore, and have been carrying around the same $100 bill since Christmas. But paying for gasoline with cash will mean making regular trips to the ATM to cover the fuel tab. If that ATM isn’t especially close, you’re actually using gas to save a little money on the stuff.

- Extra walk

Gas pumps do not accept bills, so paying with real money means walking into the gas station to tender payment in person. Plus, if you intend to fill your tank, you will likely have to overpay the expected tab, and revisit the cashier for your change.

- Temptation

Retail gas stations earn a surprising 70 percent of their net profits from products other than gas. While this includes things like oil and windshield-washer fluid, it mostly includes the likes of cigarettes, beefy jerky, and Mr. Pibb. Walking into the store opens the door to compelling sweet-and-salty temptation.

- No points for you

While going cash may save you some money, you will lose any rewards points you would have earned by using your credit card.

Does it make sense to pay with cash?

We say no. Paying cash not only adds time to your gas-station visit, it really doesn’t return much in the way of real value. Consider this: If your credit card pays you 1.0 percent cash back, there is little point to pulling out the folding money. If you purchase $1600 worth of gasoline in a given year, you receive $16.00 cash back for doing so.

By paying cash, you save a nickel for every gallon purchased, which amounts to a 1.5-percent discount, or about $24.00 annually. So, your net savings for paying cash over the course of a year comes to just $8.00. Even at a discount rate of $.10 per gallon, the savings don’t amount to much.

Better ways to save money on gas

Many gasoline retailers offer app-based rewards programs that include not only discounted fuel, but perks that include free coffee, and, at 7-11, the occasional no-cost chicken wings. Here are a few programs you may want to consider—all of which should prove more convenient that dealing with cash:

7-Eleven

The 7Rewards App features discounts on in-store purchases as well as gasoline.

Circle K

Circle K offers the convenience of paying by cash using a provided gift-style card. The card combines credit-card convenience with pay-with cash prices.

More on the Circle K Cash Card

Exxon and Mobil

These ubiquitous gasoline retailers offer discounts for gasoline as well as in-store purchase. Enroll in the Exxon Mobil Rewards+ program to earn discounts.

More on Exxon and Mobil Rewards+

Love’s

Popular on the Interstate, Love’s offers fuel discounts via the Love’s Connect App.

Walmart

Members of Walmart+ can save money on fuel at participating Exxon and Mobil stations by using the Walmart app.

Listen to the Car Stuff Podcast

Cash Discount Pictures